This post will provide a comprehensive overview of the latest trends, technologies, and market dynamics shaping the trucking industry in 2024. It will include valuable information for both seasoned truckers and newcomers, as well as insights for professionals working in logistics, management, and support roles.

Table of Contents

Navigating the Road Ahead: Economic Outlook for the Trucking Industry in 2024.

According to BTS (Bureau of Transportation Statistics) The transportation and warehousing sector is classified as NAICS 48-49. NAICS stands for North American Industrial Classification System. It is the standard used by federal statistic agencies in classifying businesses. A sector is described as a group of industries. This group of industries are categorized as the transportation and warehouse sector.

The Transportation and Warehousing sector distinguishes three basic types of activities: subsectors for each mode of transportation, a subsector for warehousing and storage, and a subsector for establishments providing support activities for transportation. In addition, there are subsectors for establishments that provide passenger transportation for scenic and sightseeing purposes, postal services, and courier services.

- Air transportation

- Rail transportation

- Truck transportation

- Water transportation

- Pipeline transportation

- Transit and ground passenger transportation

- Warehousing and Storage

- Scenic and sightseeing transportation

- Support Activities for Transportation

- Postal Service

- Couriers and Messenger

All these industries in this group as well as other sector groups could not function without supplies being shipped to and from mines, manufactures, distributors, retailers, and sometimes the consumers. These shipments are usually moved by tractor trailers.

The Transportation and Warehousing sector includes industries providing transportation of passengers and cargo, warehousing and storage for goods, scenic and sightseeing transportation, and support activities related to modes of transportation. Establishments in these industries use transportation equipment or transportation related facilities as a productive asset. The type of equipment depends on the mode of transportation. The modes of transportation are air, rail, water, road, and pipeline.

The 4 modes of the transportation and warehouse sector.

These data points collectively provide a comprehensive overview of the economic health and trends within the trucking industry. They are crucial insights into market trends, operational costs, and demand fluctuations.

- Economic Indicators: Broader economic metrics such as GDP growth, consumer spending, and manufacturing output, which influence freight demand

- Freight Demand: Measures the volume of goods transported by trucks. Often assessed through metrics such as tonnage and shipping volumes.

- Fuel Costs: The price of diesel and gasoline, which significantly impacts operating expenses.

- Driver Shortage: The gap between the number of available drivers and the demand for drivers, often quantified by the number of unfilled positions.

- Freight Rates: The price charged for transporting goods, influenced by demand, fuel costs, and other operational expenses.

- Operational Costs: Includes expenses like maintenance, insurance, permits, and salaries.

- Truck Sales and Orders: Indicates investment in new equipment and fleet expansion, reflecting industry confidence and growth.

- Regulatory Changes: New laws or changes in existing regulations affecting driver hours, emissions, safety standards, and other compliance requirements.

- Technological Adoption: Investment in technologies like telematics, autonomous vehicles, and electric trucks, affecting efficiency and cost structures.

- Freight Capacity Utilization: The percentage of the trucking fleet actively being used to transport goods, indicating supply-demand balance.

This information aids owner operators in strategic decision-making and financial planning. Future truck drivers can gauge industry health and job prospects, while drivers seeking new jobs can identify growth areas and employers with stable or expanding operations. Additionally, industry professionals, including fleet managers and logistics planners, can optimize routes, manage resources efficiently, and stay competitive in a dynamic market.

The U.S. GDP (Gross Domestic Product – a measure of economic activity). currently is just above 27 trillion U.S. Dollars, of which the transportation and warehousing sector make up 6.7% that’s 1.7 trillion dollars.

The trucking industry is a sub sector with in the transportation and warehouse sector and is sometimes referred to as Truck Transportation (NAICS 484). It’s the industry providing over-the-road transportation of freight using tractor-trailers.

While non transportation sectors depend on the trucking industry at some capacity, BTS considers transportation and warehouse sector large enough to be a stand-alone sector in terms of macroeconomics.

The Bureau of Transportation Statistics breaks truck transportation down into three categories.

- For-hire transportation services: air, rail, truck, passenger and ground transportation, pipeline, and other support services that transportation firms provide to industries and the public on a fee basis.

- In-house transportation services: air, rail, truck, and water transportation services produced by non-transportation industries for their own use (e.g., grocery stores owning and operating their own trucks to move goods from distribution centers to retail locations).

- Household transportation services: ownership and operation of motor vehicles by households. Here, BTS calculates the contribution of household transportation as the depreciation associated with households owning a motor vehicle.

The Bureau of Transportation Statistics breaks truck transportation down into three categories.

- For-hire transportation services: air, rail, truck, passenger and ground transportation, pipeline, and other support services that transportation firms provide to industries and the public on a fee basis.

- In-house transportation services: air, rail, truck, and water transportation services produced by non-transportation industries for their own use (e.g., grocery stores owning and operating their own trucks to move goods from distribution centers to retail locations).

- Household transportation services: ownership and operation of motor vehicles by households. Here, BTS calculates the contribution of household transportation as the depreciation associated with households owning a motor vehicle.

In 2021 Trucking made the highest contribution among all freight modes, totaling $389.3 billion. This included $185.1 billion from for-hire transportation services and $204.2 billion from in-house trucking operations. In contrast, household transportation contributed $411.5 billion to GDP, surpassing any other transportation mode.

Trucking's Dominance in Freight Contribution and Commodity Transport Analysis by Weight and Value

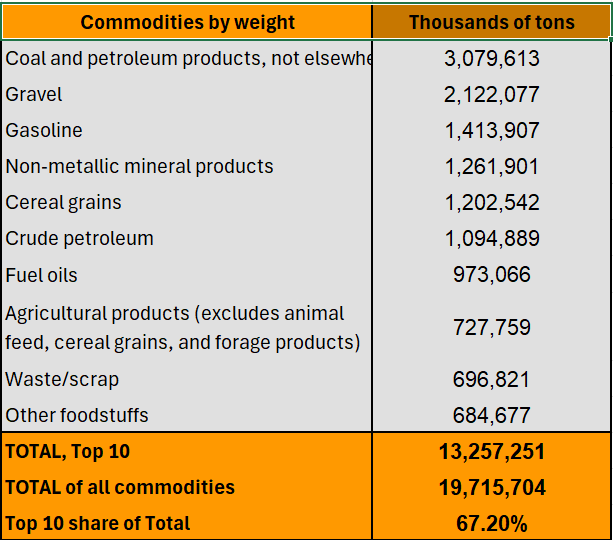

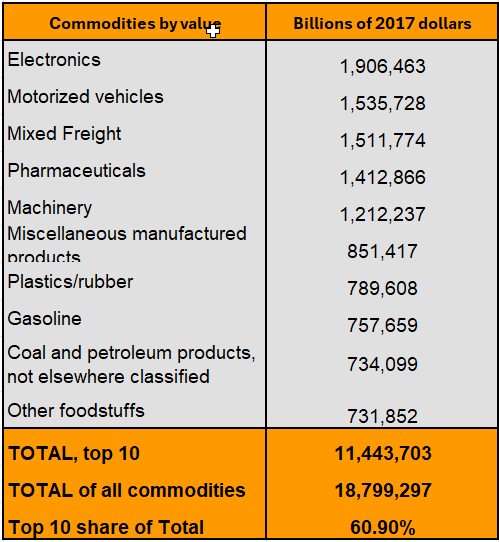

In 2023, the top 10 commodities by weight comprised 64.9 percent of the total tonnage, whereas the top 10 commodities by value made up 59.7 percent of the total value of goods transported. The leading commodities by weight included natural gas and other fossil fuel products, gravel, gasoline, and nonmetallic mineral products. In terms of value, the leading commodities were high value-per-ton goods such as electronics, motorized vehicles, mixed freight (primarily food), and pharmaceuticals

For a broad view approach or general idea on whether there is enough supply of freight to meet the demand for truck transportation, weight and value across the top 10 commodities is one of the best metrics to evaluate.

The top 10 commodities by weight usually consisting of what is known as bulk products or raw goods.

The total value of goods moved in 2023. These commodities are high value-per-ton- goods.

Understanding the different types of freight and the volume moved across America is crucial for those considering a trucking career. Here’s why this knowledge can help…..

- Identifying Opportunities and Demand

Knowing which types of freight are most commonly transported can help prospective truckers identify where there is steady demand for services. Key freight types include:

- Dry Van Freight: General goods, non-perishable items.

- Refrigerated (Reefer) Freight: Perishable goods requiring temperature control.

- Flatbed Freight: Construction materials, large machinery.

- Tankers: Liquids, chemicals, fuels.

- Specialized/Heavy Haul: Oversized loads, unique cargo requiring special handling.

- Determining Income Potential

Different types of freight can yield different income levels. For example, specialized freight often pays more due to the additional skills and equipment required. Understanding which sectors pay more can help truckers make informed career choices.

- High-Paying Sectors: Hazardous materials, oversized loads, specialty vehicles.

- Moderate-Paying Sectors: Refrigerated freight, tanker freight.

- Standard-Paying Sectors: Dry van freight, flatbed freight.

- Evaluating Required Skills and Certifications

Certain freight types require specific skills or certifications. For instance:

- Hazardous Materials: Requires a Hazmat endorsement.

- Tanker Freight: Requires a Tanker endorsement.

- Refrigerated Freight: Requires knowledge of temperature control systems.

Understanding these requirements can help aspiring truckers plan their training and certification paths.

- Considering Lifestyle and Work Conditions

Different freight types come with varying work conditions and lifestyle impacts. For example:

- Long-Haul vs. Regional/Local: Long-haul trucking often means being away from home for extended periods, while regional or local routes can allow for more home time.

- Physical Demand: Flatbed trucking involves more physical labor due to securing loads, while dry van trucking is less physically demanding.

- Work Environment: Reefer drivers might deal with stricter delivery schedules due to the perishable nature of their cargo.

- Geographic Considerations

Certain types of freight are more prevalent in specific regions. For example:

- Agricultural Produce: Common in the Midwest and California.

- Manufactured Goods: More prevalent in industrial regions like the Northeast and Midwest.

- Oil and Gas: High demand in states like Texas and North Dakota.

Understanding regional demand can help truckers choose their base of operations or decide if relocating could offer better opportunities.

- Economic and Seasonal Variations

Freight volumes can fluctuate based on economic conditions and seasonal demand. For instance:

- Retail Goods: Increase during holiday seasons.

- Agricultural Produce: Seasonal peaks during harvest times.

- Construction Materials: Higher demand during warmer months.

Being aware of these variations can help truckers plan their work schedules and financial strategies.

- Industry Trends and Future Outlook

Staying informed about industry trends, such as shifts towards e-commerce or changes in regulations, can help truckers adapt and find new opportunities. For instance:

- E-commerce Growth: Increasing demand for freight services to deliver goods bought online.

- Green Initiatives: Growing need for drivers trained in operating electric or alternative fuel vehicles.

Understanding the different types of freight and the volume moved across America helps aspiring truckers make informed decisions about their careers by providing insights into demand, income potential, required skills, lifestyle impacts, regional opportunities, economic and seasonal variations, and industry trends. This comprehensive knowledge allows truckers to tailor their career paths to align with their personal preferences, financial goals, and long-term aspirations.

All freight is not equal. The volume of freight moved by truck transportation fluctuates based on various dynamics. These dynamics are not mutually exclusive, in fact they work in tandem with each other creating the fluctuation in available freight.

Seasonal Changes in Freight and Retail:

Holiday Season Spending:

The holiday season is the peak period for consumer spending in retail. Specific commodities that see increased sales include:

- Electronics: Smartphones, tablets, laptops, gaming consoles

- Apparel: Winter clothing, holiday-themed outfits, accessories

- Toys and Games: Children’s toys, board games, video games

- Home Goods: Decorations, kitchen appliances, furniture

- Food and Beverages: Special holiday foods, wines, spirits

- Gifts: Jewelry, books, beauty products

Climate Impact on Freight Movement:

- Tornado Season (Spring/Summer):

- Challenges: Heavy rain, potential tornadoes

- Impact: Road closures, accidents, delays in deliveries, trucks stranded at truck stops

- Winter Season:

- Challenges: Snow, ice, freezing temperatures

- Impact: Hazardous driving conditions, road closures, major accidents, delays, trucks unable to leave locations

Economic Downturns:

- Indicators: Reduced consumer spending, lower business investments

- Impact on Freight:

- Decreased volume of goods being transported

- Reduced purchase power affects retailers, contractors, and consumers

- Fuel prices may fluctuate, affecting operating costs for trucking companies

Global Calamities:

- Example: COVID-19 Pandemic:

- Challenges: Limited freight movement despite truckers being essential workers

- Impact:

- State lockdowns leading to reduced transportation needs

- Closed shipping ports, hindering imports and exports

- Decreased overall economic activity, leading to fewer goods being transported

Summary Chart:

Season/Factor | Challenges | Impact on Freight |

Holiday Season | Increased consumer demand | High volume of retail goods, peak spending on specific commodities |

Tornado Season | Heavy rain, tornadoes | Road closures, delays, stranded trucks |

Winter Season | Snow, ice, freezing temperatures | Hazardous conditions, road closures, accidents, delays |

Economic Downturns | Reduced spending, lower investments | Decreased freight volume, affected fuel prices |

Global Calamities | State lockdowns, closed ports (e.g., COVID-19) | Limited freight movement, reduced imports/exports |

This summary highlights how seasonal changes and external factors significantly influence consumer behavior, freight movement, and the overall economy.

Seasonal Changes

- The holiday season is the time of year that consumers spend the most money in retail. List or chart the specific commodities

- Climate also affects the movement of freight from tornado season (which means lots of rain) or winter season where there is snow and ice. These adverse road conditions close roads or cause major accidents, leaving trucks stuck at truck stops or not leaving a location.

- Economic downturns are an example of the most obvious reflection of slow freight movement. It affects purchase power for consumers, contractors, retailers and fuel prices.

- Global calamities should be considered due to a recent event which was COVID-19. Even though truckers were considered “essential workers” there was very limited freight being moved. Some states were completely shut down and shipping ports weren’t receiving imports.

The Nation’s 129.9 million households, over 7.9 million business establishments, and 90,000 governmental units all contribute to an economy reliant on efficient freight movement. As the U.S. population and economic activity have expanded domestically and globally, freight transportation has correspondingly increased.

While transportation contributes less to GDP than many other industries and sectors, all rely on transportation to acquire the raw materials, production supplies and equipment needed to produce and deliver their products to businesses and households.

Supply Chain Content

The American economy spans an entire continent and maintains global connections, utilizing natural resources and manufactured goods from various locations to cater to both domestic and international markets. Increasingly, freight is being transported over longer distances within extensive supply chains involving distant trading partners.

What is a supply chain?

A supply chain is a network of individuals and companies involved in producing and delivering a product to the consumer. This chain starts with the producers of raw materials and ends with the delivery of the finished product to the user.

The operations of a supply chain is mostly global due to the outsourcing of manufacturing labor and the mining of raw materials in other countries.

The supply chain process encompasses a series of steps that businesses follow to transform raw materials into final products and deliver them to customers. The end of each process usually require an 18 Wheeler to deliver it to the next process. Here’s a detailed explanation of each stage in the supply chain process:

Truck transport plays a critical role in the supply chain process, facilitating the movement of raw materials from mines to manufacturers and ultimately delivering finished products to consumers. Here’s a detailed explanation of how truck transport assists in each stage of the supply chain from mines to the consumer:

- Transporting Raw Materials from Mines

Collection and Initial Transport:

- Trucks are used to transport raw materials, such as minerals and ores, from mining sites to processing facilities.

- These trucks are often specially designed to handle heavy loads and rough terrain typical of mining environments.

Intermediate Storage and Processing:

- Trucks deliver raw materials to intermediate storage facilities or directly to processing plants where the materials undergo initial processing.

- This stage may involve multiple trips as raw materials are moved between different facilities for various stages of processing.

- Transporting Processed Materials to Manufacturers

Long-Haul Transport:

- After initial processing, trucks transport refined materials to manufacturing facilities. This often involves long-haul trucking over considerable distances.

- Trucks are chosen for their ability to handle large volumes and provide reliable, flexible service across extensive logistics networks.

- Distributing Components and Subassemblies

Supplier to Manufacturer:

- Trucks are used to transport components and subassemblies from suppliers to manufacturers, often as part of a Just-In-Time (JIT) inventory system.

- This ensures that manufacturers receive the necessary parts exactly when needed, minimizing inventory costs and reducing storage requirements.

- Transporting Finished Products to Warehouses and Distribution Centers

Warehouse Delivery:

- Once products are manufactured, trucks transport finished goods to warehouses and distribution centers.

- These facilities store products until they are ready for distribution to retailers or direct shipment to consumers.

- Last-Mile Delivery to Consumers and Retailers

Retail Distribution:

- Trucks deliver products from warehouses and distribution centers to retail stores. This step ensures that retail shelves are stocked and ready for consumer purchase.

- Efficient trucking logistics ensure timely delivery and reduce stockouts at retail locations.

Direct-to-Consumer Delivery:

- For e-commerce and direct-to-consumer sales, trucks play a crucial role in last-mile delivery.

- This involves transporting packages from distribution centers directly to consumers’ homes, often using smaller delivery trucks or vans.

Key Benefits of Truck Transport in the Supply Chain:

Flexibility:

- Trucks offer flexibility in terms of routing and scheduling, allowing companies to adjust quickly to changes in demand or supply chain disruptions.

- They can access remote and rural areas that might not be reachable by other modes of transport.

Cost-Effectiveness:

- Trucking is generally cost-effective for short to medium distances, making it an economical choice for many stages of the supply chain.

- It allows for consolidation of shipments, reducing overall transportation costs.

Speed and Reliability:

- Trucks provide relatively fast transportation compared to some other modes, ensuring timely delivery of goods.

- Reliable trucking services help maintain tight schedules and support JIT inventory systems.

Scalability:

- Truck transport can easily scale up or down based on demand, with the ability to add more trucks or adjust routes as needed.

- This scalability supports seasonal variations in demand and helps manage peak periods effectively.

Integration with Other Transport Modes:

Intermodal Transport:

- Trucks often work in conjunction with other transport modes, such as rail, air, and sea. For example, they may transport goods from a mine to a railhead or port, where the materials continue their journey.

- This intermodal approach leverages the strengths of each transport mode, optimizing the overall efficiency of the supply chain.

Enhanced Logistics:

- Advanced logistics systems and technologies, including GPS tracking and fleet management software, improve the efficiency and reliability of truck transport.

- These technologies help manage routes, monitor vehicle performance, and ensure real-time communication, enhancing overall supply chain coordination.

In summary, truck transport is a vital component of the supply chain, ensuring the efficient movement of goods from mines to consumers. Its flexibility, cost-effectiveness, speed, and scalability make it indispensable for maintaining a smooth and responsive supply chain.

The Value of freight is foretasted by mainly two metrics combined as one, is price per ton. The legal amount of weight allowed to haul on a 5-axle tractor trailer is a maximum of 80,000 lbs (20 tons). This usually amounts to 48,000 to 51,000 lbs (approximately 25 tons) depending on the truck’s and trailer’s empty weight together. In other cases, the load pays what it pays per mile or a flat rate based on government-regulated fuel prices and other factors such as demand for that commodity and the value.

Freight Availability

Finding loads for trucks is a crucial aspect of the trucking industry, and owner-operators, load planners, and dispatchers each have specific strategies and tools to secure these loads. Here’s how they typically find loads:

Owner-Operators

Owner-operators are independent truck drivers who own and operate their own trucks. They often use a combination of the following methods to find loads:

- Load Boards: Online platforms like DAT, Truckstop.com, and 123Loadboard allow owner-operators to search for available loads. These platforms list loads posted by shippers and brokers, and owner-operators can bid on or accept loads that match their criteria.

- Freight Brokers: Owner-operators often work with freight brokers who act as intermediaries between shippers and carriers. Brokers have access to a wide range of loads and can help owner-operators find suitable hauls.

- Direct Shipper Contracts: Establishing direct relationships with shippers can provide a more consistent source of loads. This often involves negotiating contracts directly with manufacturers, retailers, or other companies that need goods transported.

- Networking: Building a network of contacts within the industry can help owner-operators find loads through referrals and word-of-mouth recommendations.

- Mobile Apps: Various mobile apps like Uber Freight, Convoy, and Cargomatic provide a platform for finding and booking loads directly from a smartphone.

Dispatchers

Dispatchers manage the day-to-day operations of trucking fleets, assigning loads to drivers and ensuring timely delivery. They find loads using:

- Load Boards and Freight Brokers: Similar to owner-operators, dispatchers use load boards and work with freight brokers to find loads that fit their drivers’ schedules and routes.

- Carrier Networks: Many dispatchers work within a network of carriers, sharing loads and resources to ensure trucks are always moving.

- Customer Relationships: Dispatchers maintain relationships with regular customers to secure repeat business and ensure a steady flow of loads.

- Real-Time Tracking and Communication: Utilizing GPS tracking and communication tools, dispatchers can monitor truck locations and availability in real-time, helping them to quickly find and assign loads.

- TMS Integration: Dispatchers often use transportation management systems to automate load matching, optimize routes, and manage dispatch operations efficiently.

By leveraging these strategies and tools, owner-operators, load planners, and dispatchers can effectively find and secure loads, ensuring that trucks are utilized efficiently and profitability is maximized.

Equipment

Trucking equipment encompasses a wide range of tools, devices, and systems used in the operation, maintenance, and enhancement of trucks and trucking operations. Here’s an overview of the main categories and examples of trucking equipment:

- Truck Types and Trailers

- Semi-Trucks (Tractor Units): The primary vehicle for long-haul trucking, often paired with various types of trailers.

- Flatbed Trailers: Used for transporting large or bulky items that do not require enclosure.

- Dry Van Trailers: Enclosed trailers used for general cargo.

- Refrigerated Trailers (Reefers): Insulated trailers with refrigeration units for transporting perishable goods.

- Tankers: Used for transporting liquids or gases.

- Dump Trucks: Equipped with a hydraulic lift to unload materials like sand, gravel, or waste.

- Cargo Handling Equipment

- Forklifts: Essential for loading and unloading cargo.

- Pallet Jacks: Manual or electric tools used to move palletized goods.

- Liftgates: Hydraulic or electric platforms on the back of trucks for lifting heavy cargo.

- Safety and Compliance Equipment

- Electronic Logging Devices (ELDs): Mandated for tracking drivers’ hours of service.

- Dash Cameras: Record driving activity for safety and insurance purposes.

- Reflective Tape and Markings: Enhance visibility of trucks, especially at night.

- Fire Extinguishers: Required safety equipment on all trucks.

- Load Securement Devices: Straps, chains, and binders to secure cargo.

- Communication and Navigation

- CB Radios: Traditional communication tool among truck drivers.

- GPS Systems: Essential for navigation and route planning.

- Fleet Management Software: Helps dispatchers track trucks, manage routes, and monitor driver performance.

- Maintenance and Repair Tools

- Diagnostic Tools: OBD-II scanners for checking engine and system codes.

- Tire Inflation Systems: Automatic systems to maintain optimal tire pressure.

- Tool Kits: Comprehensive sets for on-the-road repairs and maintenance.

- Comfort and Convenience

- Sleeper Cab Accessories: Bedding, mini-fridges, microwaves for long-haul drivers.

- Heating and Air Conditioning Units: For maintaining a comfortable cab environment.

- Entertainment Systems: Radios, TVs, and other electronics for downtime.

- Specialized Equipment

- Hazardous Materials (Hazmat) Equipment: Special containment systems and signage for transporting hazardous materials.

- Logging Trailers: Designed for hauling logs and timber.

- Livestock Trailers: Equipped to transport animals safely.

- Sustainability and Fuel Efficiency

- Aerodynamic Devices: Fairings, side skirts, and other add-ons to reduce drag and improve fuel efficiency.

- Alternative Fuel Systems: LNG, CNG, and electric drivetrains for more eco-friendly operations.

- Idle Reduction Technologies: Systems that reduce the need for idling, saving fuel and reducing emissions.

These categories cover a broad spectrum of trucking equipment, each critical for different aspects of the industry. From basic safety tools to advanced technology for improving efficiency and sustainability, the right equipment can significantly impact a trucking operation’s effectiveness and profitability.

Accounting

Managing the budget and accounting for a trucking company involves several key components. Below is an outline of the important aspects to consider:

Budgeting for a Trucking Company

- Revenue Forecasting

- Freight Rates: Estimate the revenue based on contracted and spot market rates.

- Load Volume: Project the number of loads and miles to be driven.

- Seasonal Variations: Consider peak and off-peak seasons.

- Operational Costs

- Fuel Costs: Include fluctuations in fuel prices and fuel efficiency of trucks.

- Driver Wages: Salary, benefits, bonuses, and overtime.

- Maintenance and Repairs: Regular maintenance and unexpected repairs.

- Tires and Parts: Replacement of tires and other essential parts.

- Licensing and Permits: Fees for operating in different regions.

- Insurance: Coverage for vehicles, cargo, and liability.

- Administrative Expenses

- Office Rent and Utilities: Costs of running the office.

- Salaries for Non-Driving Staff: Dispatchers, accountants, HR personnel, etc.

- Office Supplies and Technology: Computers, software, phones, etc.

- Capital Expenditures

- Purchase of Trucks and Trailers: New acquisitions or leasing costs.

- Technology Upgrades: Fleet management systems, GPS, etc.

- Debt Service

- Loan Repayments: Principal and interest on loans for trucks and other capital investments.

- Contingency Fund

Emergency Funds: For unforeseen expenses or downturns in business

Accounting for a Trucking Company

- Revenue Recognition

- Invoicing: Accurate and timely invoicing for services rendered.

- Accounts Receivable: Monitoring and managing collections.

- Expense Tracking

- Accounts Payable: Managing payments to suppliers and vendors.

- Payroll Accounting: Ensuring timely and accurate payment of wages and benefits.

- Cost Allocation

- Direct Costs: Fuel, maintenance, driver wages directly related to truck operations.

- Indirect Costs: Overhead expenses like administrative salaries and office expenses.

- Depreciation

- Asset Depreciation: Accounting for the wear and tear of trucks and trailers over time.

- Financial Reporting

- Profit and Loss Statement: Monthly and yearly P&L to monitor profitability.

- Balance Sheet: Snapshot of the company’s financial position at a given time.

- Cash Flow Statement: Tracking cash inflows and outflows to ensure liquidity.

- Tax Compliance

- Tax Filings: Ensuring timely and accurate filing of federal, state, and local taxes.

- IFTA Reporting: International Fuel Tax Agreement reports for fuel usage.

- Auditing and Internal Controls

- Internal Audits: Regular audits to ensure accuracy and compliance with regulations.

- Fraud Prevention: Systems and checks to prevent and detect fraud.

- Software and Systems

- Accounting Software: Use of specialized accounting software tailored for trucking.

- Fleet Management Systems: Integration of fleet management with accounting systems for better data accuracy.

Key Metrics and KPIs (Key Performance Indicators)

- Cost Per Mile/Kilometer: Tracking all costs per unit of distance.

- Revenue Per Mile/Kilometer: Monitoring revenue generated per unit of distance.

- Operating Ratio: Ratio of operating expenses to revenue.

- Utilization Rate: Percentage of time trucks are on the road earning revenue.

- Deadhead Percentage: Percentage of miles driven without a load.

Example of a Simple Budget Outline

|

Category |

Monthly Estimate |

Annual Estimate |

|

Revenue |

||

|

Freight Revenue |

$100,000 |

$1,200,000 |

|

Total Revenue |

$100,000 |

$1,200,000 |

|

Operational Costs |

||

|

Fuel |

$20,000 |

$240,000 |

|

Driver Wages |

$25,000 |

$300,000 |

|

Maintenance |

$5,000 |

$60,000 |

|

Tires and Parts |

$2,000 |

$24,000 |

|

Insurance |

$3,000 |

$36,000 |

|

Licensing and Permits |

$1,000 |

$12,000 |

|

Total Operational Costs |

$56,000 |

$672,000 |

|

Administrative Costs |

||

|

Office Rent and Utilities |

$2,000 |

$24,000 |

|

Salaries for Non-Driving Staff |

$8,000 |

$96,000 |

|

Office Supplies and Technology |

$1,000 |

$12,000 |

|

Total Administrative Costs |

$11,000 |

$132,000 |

|

Capital Expenditures |

||

|

Truck Payments |

$5,000 |

$60,000 |

|

Technology Upgrades |

$1,000 |

$12,000 |

|

Total Capital Expenditures |

$6,000 |

$72,000 |

|

Debt Service |

$2,000 |

$24,000 |

|

Contingency Fund |

$1,000 |

$12,000 |

|

Total Costs |

$76,000 |

$912,000 |

|

Net Profit |

$24,000 |

$288,000 |

Properly managing the budget and accounting processes ensures the financial health and sustainability of a trucking company. Using specialized software and maintaining robust internal controls can significantly improve accuracy and efficiency.

Careers

The trucking industry offers a diverse range of career opportunities, catering to various skill sets and interests. Here are some of the primary careers in the trucking industry:

- Truck Drivers

- Long-Haul Truck Drivers: Drive across states or countries, often spending weeks on the road.

- Short-Haul/Local Truck Drivers: Operate within a specific region, allowing drivers to return home daily.

- Specialized Truck Drivers: Handle specific types of cargo, such as hazardous materials, oversized loads, or refrigerated goods.

- Owner-Operators: Independent drivers who own and operate their trucks, contracting their services to various companies.

- Freight and Logistics

- Freight Brokers: Act as intermediaries between shippers and carriers, arranging transportation and negotiating rates.

- Logistics Coordinators: Plan and manage the logistics of transporting goods, ensuring efficient and cost-effective delivery.

- Dispatchers: Assign drivers to routes, manage schedules, and ensure timely delivery of goods.

- Fleet Management

- Fleet Managers: Oversee the operation and maintenance of a fleet of vehicles, ensuring compliance with regulations and optimizing efficiency.

- Maintenance Managers: Supervise the maintenance and repair of trucks, ensuring vehicles are in safe and working condition.

- Safety and Compliance

- Safety Directors: Develop and enforce safety policies, conduct training, and ensure compliance with industry regulations.

- Compliance Officers: Monitor adherence to federal, state, and local regulations, including hours-of-service and environmental standards.

- Warehouse and Distribution

- Warehouse Managers: Oversee the storage and distribution of goods within a warehouse, managing inventory and staff.

- Forklift Operators: Handle the loading and unloading of cargo using forklifts and other equipment.

- Inventory Specialists: Track and manage inventory levels, ensuring accurate records and efficient stock management.

- Sales and Customer Service

- Sales Representatives: Promote and sell transportation services to potential clients, negotiating contracts and rates.

- Customer Service Representatives: Handle client inquiries, track shipments, and resolve any issues related to transportation services.

- Technicians and Mechanics

- Diesel Mechanics: Specialize in the repair and maintenance of diesel engines used in trucks.

- Trailer Technicians: Focus on maintaining and repairing trailers, ensuring they are roadworthy and compliant with safety standards.

- Administrative and Support Roles

- Human Resources Specialists: Manage hiring, training, and employee relations within trucking companies.

- Accountants/Bookkeepers: Handle financial records, invoicing, and budgeting for trucking operations.

- IT Specialists: Support the technology needs of trucking companies, including fleet management software and communication systems.

- Environmental and Sustainability Roles

- Sustainability Coordinators: Develop and implement strategies to reduce the environmental impact of trucking operations.

- Alternative Fuel Technicians: Specialize in maintaining and repairing trucks that use alternative fuels, such as electric or natural gas.

- Training and Education

- Driver Trainers: Provide instruction and training to new truck drivers, ensuring they meet licensing and safety standards.

- Technical Instructors: Teach courses on truck maintenance, repair, and other technical aspects of the trucking industry.

These careers offer various pathways for individuals interested in the trucking industry, whether they prefer being on the road, working behind the scenes, or engaging in technical and administrative roles. The industry is vital to the economy, providing numerous opportunities for growth and advancement.

Summary

This concludes our overview of the trucking industry and the main topics that are important to professional drivers and industry professionals. However, this only an overview as opposed to a more detailed drill down on each subject. We will cover all the subjects in the article more extensively in future articles. Until then Keep on Trucking!

Also, this will be the pillar content of this website which we will update periodically.